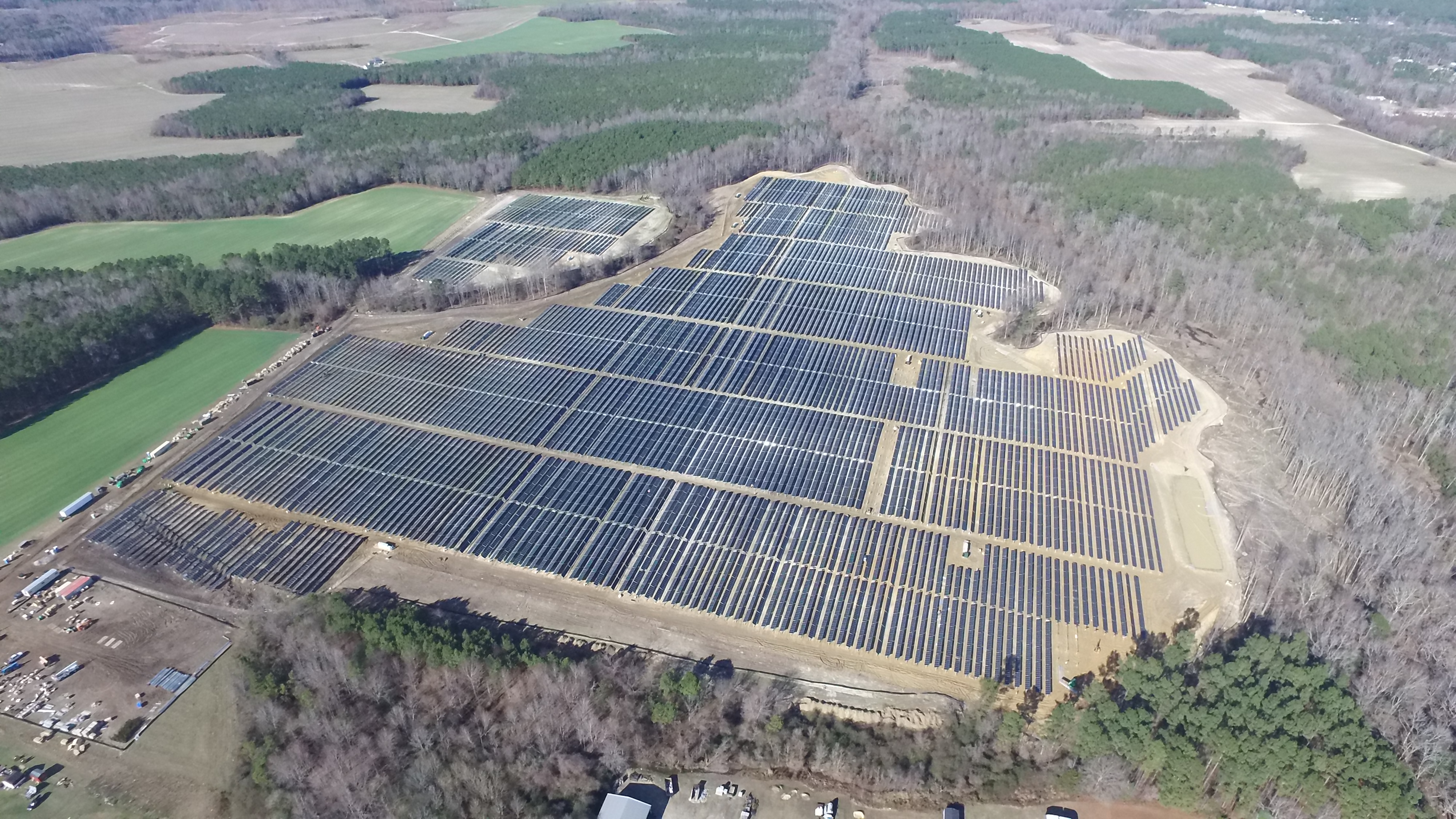

SAN FRANCISCO, CA. (September 2, 2020) – Kruger Energy, a business unit of Kruger Inc. specializing in the development and management of renewable energy power plants, has sold a 523MW mid-stage solar development portfolio to Ecoplexus, a leading renewables IPP. The development portfolio, located in Georgia and Tennessee, will provide clean energy to hundreds of thousands of households in the Southeast upon completion.

As a part of the sale, Ecoplexus will continue developing the five-project portfolio, with targeted commercial operation dates in 2022 and 2023. The portfolio is well-positioned in the Southeast, one of the fastest-growing solar markets with strong increased demand from utility, cooperative, and corporate offtakers.

CohnReznick Capital served as exclusive financial advisor to Kruger Energy on the transaction.

About Ecoplexus Inc.

Ecoplexus is a leading international, integrated midsize renewable energy and energy storage developer, owner, and operator with a proven record of development, growth and profitability. Ecoplexus has expanded its presence to 6 countries and has developed and deployed 70+ solar facilities worldwide and closed financing transactions in excess of $825 million.

About Kruger Energy

Kruger Energy is a business unit of Kruger Inc. and specializes in the development and management of renewable energy power plants. Kruger Energy manages and operates 42 production sites across North America, ranging from hydroelectric, wind, solar, energy storage, and biomass cogeneration plants, with a total installed capacity of 542 MW.

About CohnReznick Capital

At CohnReznick Capital, we provide superior investment banking services to the sustainability sector. Since 2008, we have executed more than 175 project and corporate transactions for renewable energy assets valued at over $24 billion in aggregate. We are wholly committed to the clean energy transition and deliver exceptional services for financial institutions, infrastructure funds, strategic participants (IPPs and utilities), and leading global clean energy developers. Our team of experts helps our clients break through the dynamic and evolving sustainability sector by simplifying project finance, M&A, capital raising, and special situations. To learn more, please visit www.cohnreznickcapital.com, follow @CR_Capital on Twitter, and connect with us on LinkedIn.